Future Trends in Excavator Engine Parts: What Global Buyers Should Anticipate in 2025

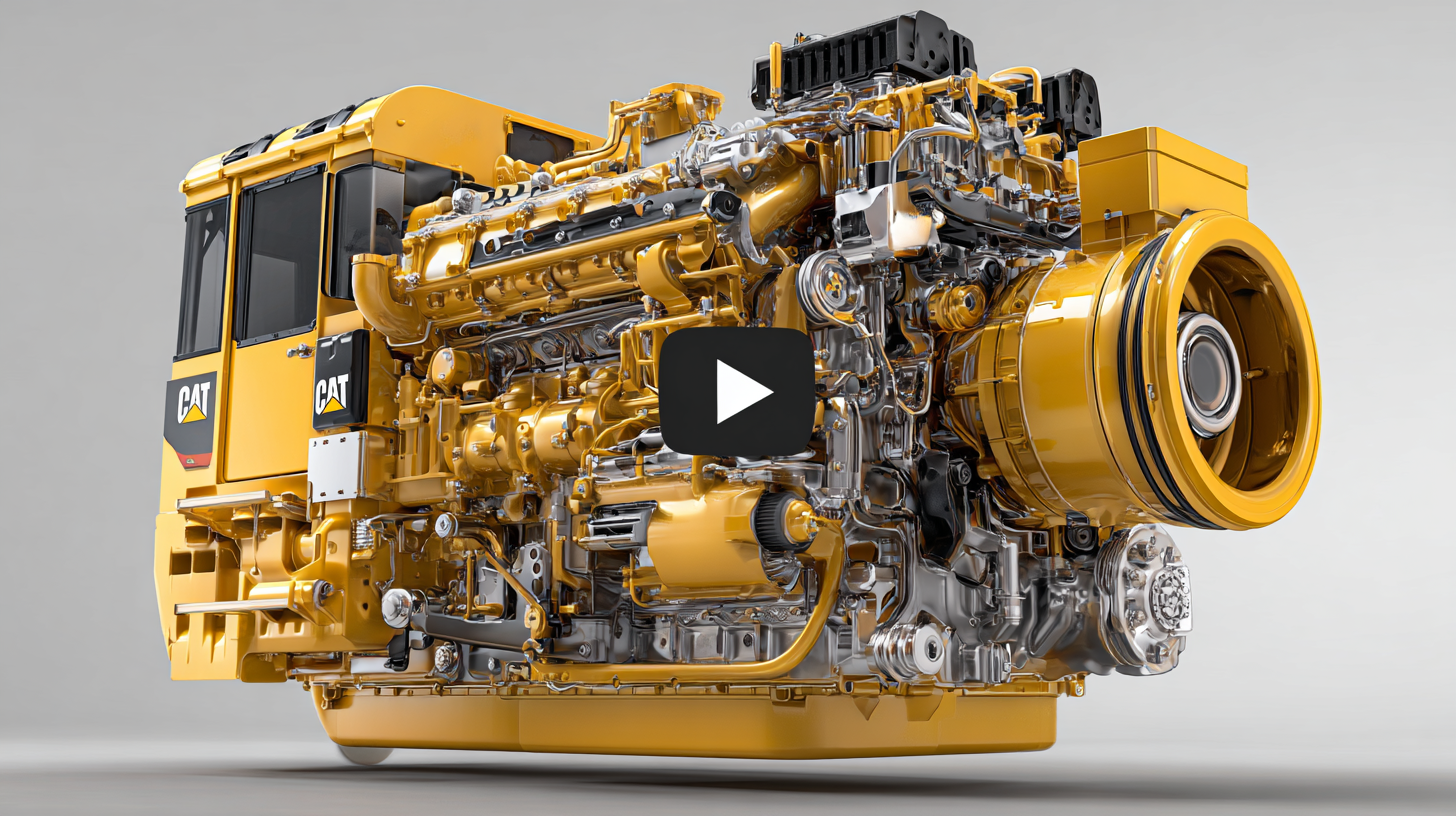

As we look towards 2025, the landscape of Excavator Engine Parts is poised for significant transformation, driven by advancements in technology and shifting market demands. According to a recent report by MarketsandMarkets, the global excavator market is expected to grow from $45 billion in 2021 to over $67 billion by 2025, highlighting a surge in the need for innovative engine components that enhance efficiency and sustainability. Furthermore, the rise of smart construction technologies is expected to play a pivotal role in reshaping the engine parts industry, with a projected CAGR of 12% during the forecast period. This rapidly evolving environment calls for global buyers to stay ahead of the curve by understanding emerging trends and adopting top strategies that leverage these technological advancements. As we delve into the key trends and strategies that will define Excavator Engine Parts by 2025, it is essential to align with industry shifts to harness opportunities effectively.

Emerging Trends in Aftermarket Service for Excavator Engine Parts

As the aftermarket service landscape for excavator engine parts evolves, several emerging trends are taking shape that global buyers should be mindful of as they navigate 2025. According to recent studies, there is increasing pressure for companies to adopt sustainable practices, with over 70% of industry stakeholders prioritizing environmental concerns. This shift is not only driven by consumer demand but also by regulatory frameworks surrounding the construction equipment sector, urging businesses to consider the lifecycle impact of their parts and services.

One notable trend is the growing reliance on data analytics and telematics, enabling predictive maintenance and efficient inventory management. This data-driven approach is poised to enhance the durability and performance of excavator engine parts, offering significant cost-savings in the long run. Tips for global buyers include investing in suppliers who leverage technology to improve service offerings, ensuring that they can meet increased demands for sustainability and durability.

Additionally, outsourcing parts and service functions is becoming more common, with a significant portion of construction OEMs looking to streamline operations. This trend may provide an opportunity for specialized aftermarket service providers to emerge, focused on delivering higher quality and reliability. Buyers should consider partnerships that not only promise quick turnaround but also align with the sustainability goals increasingly sought in the market.

Future Trends in Excavator Engine Parts (2025)

This chart highlights the anticipated growth percentages in key trends for excavator engine parts by 2025. As sustainability and technology become increasingly important, the aftermarket service sector is expected to adapt significantly.

Impact of Maintenance Costs on Global Buyers' Decisions

As we approach 2025, global buyers of excavator engine parts must pay close attention to the impact of maintenance costs on their purchasing decisions. With growing competition and pressure to optimize operations, understanding the long-term expenses associated with engine parts is critical. The trend towards more fuel-efficient and reliable components can initially deter buyers due to higher upfront costs, but these parts often lead to significant savings in maintenance and operational costs over their lifespan.

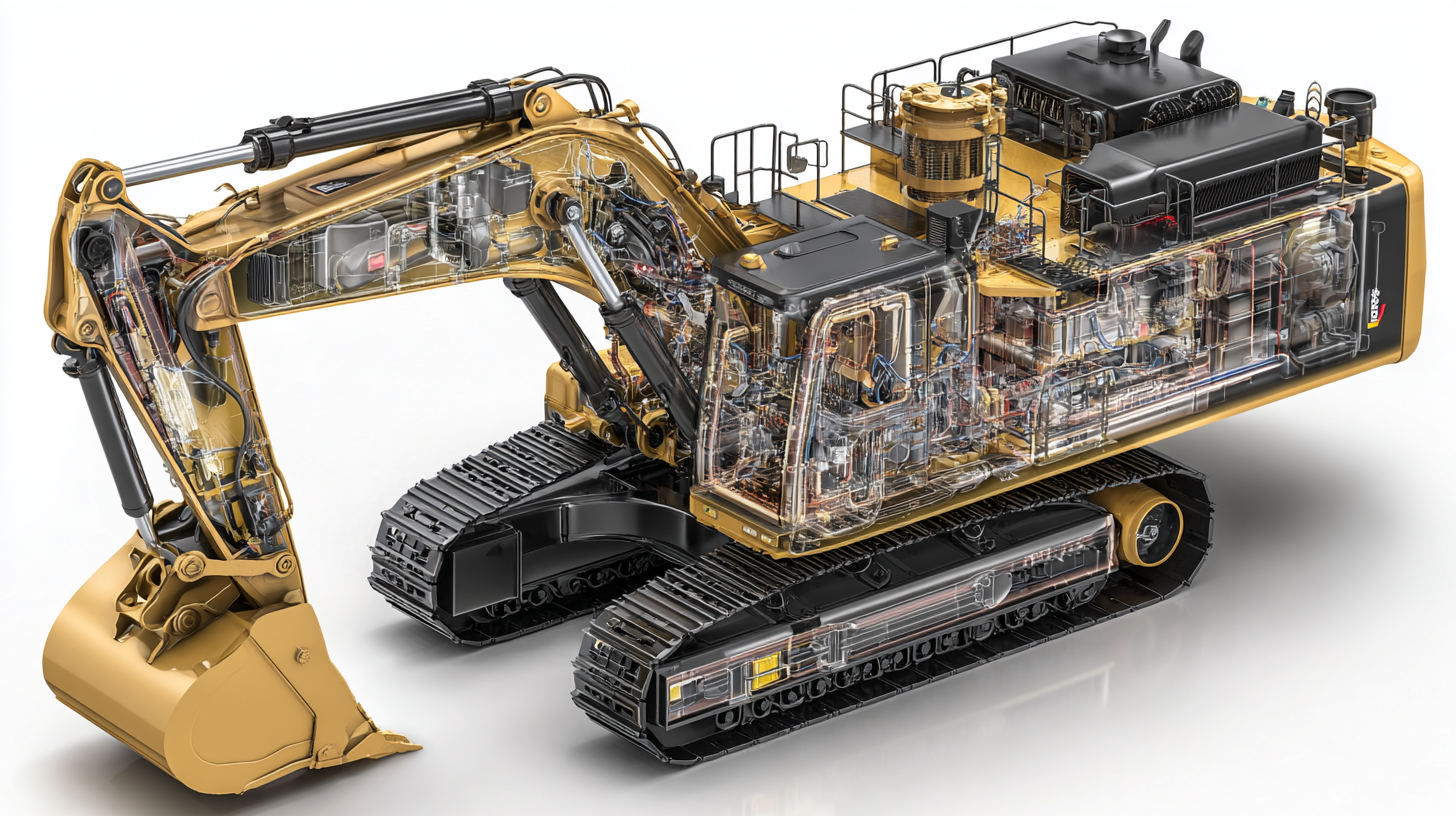

Moreover, advancements in technology are transforming the landscape of excavator engine parts. Buyers should anticipate a shift towards modular designs that facilitate easier repairs and replacements. These designs not only reduce maintenance time but also contribute to lower costs by allowing for targeted upgrades rather than complete system overhauls. Additionally, the integration of smart technologies into engine parts will enable better monitoring and predictive maintenance, further decreasing unexpected downtime and costs. As buyers weigh their options, the overall lifecycle cost of engine parts will become a paramount factor influencing their investments.

Technological Advances Enhancing Repair Effectiveness

As we look towards 2025, the future of excavator engine parts is significantly impacted by technological advancements that enhance repair effectiveness. A recent report from Research and Markets indicates that the global construction equipment market is projected to grow at a CAGR of 5.9% from 2021 to 2026. This growth drives innovations in parts and repair technologies, making maintenance more efficient than ever.

One notable trend is the integration of IoT (Internet of Things) technology into excavator engine systems, which allows for real-time monitoring and predictive maintenance. According to a study by Deloitte, companies utilizing IoT analytics can reduce equipment downtime by up to 50%. This not only improves repair turnaround times but also minimizes costs associated with prolonged operational halts. Additionally, advancements in 3D printing are streamlining the manufacturing of engine parts, enabling rapid production of custom components on-site, thereby reducing lead times and ensuring that repairs are carried out with maximum efficiency.

Moreover, AI-driven diagnostic tools are set to revolutionize the repair landscape, with an estimated 40% of companies expected to adopt such technologies by 2025 according to an Accenture survey. These technologies enable technicians to diagnose issues more accurately and swiftly, further enhancing the effectiveness of repairs and ensuring excavators remain operational longer. As global buyers prepare for the upcoming trends, investing in these advanced technologies will be key to staying ahead in a competitive market.

Understanding Warranty Implications in Excavator Parts Purchases

As global buyers navigate the dynamic landscape of excavator engine parts by 2025, understanding warranty implications becomes increasingly critical. The recent trend indicates a rise in total warranty claims among U.S.-based manufacturers, reflecting the broader economic picture influenced by factors like inflation. Reports have shown that warranty accruals and reserves increased significantly in 2023, underscoring the importance of purchasing parts with robust warranty coverage. Buyers should prioritize products that not only meet their immediate operational needs but also provide solid long-term support.

With the looming impact of tariffs on imported vehicle parts, including excavators, buyers must be vigilant about how warranty terms may evolve. The recent announcement of a 25% tariff on imported automotive parts could lead to higher costs and altered warranty conditions. Buyers may face steeper prices as manufacturers adjust to the increasing price of parts and extended warranties. Understanding warranty coverage is more crucial than ever, as it could determine the overall value proposition when investing in excavator engine parts.

Strategies for Optimizing Maintenance and Service in 2025

As the construction industry gears up for 2025, optimizing maintenance and service strategies for excavator engine parts will be crucial for global buyers. With advancements in technology, companies must embrace a data-driven approach to enhance the longevity and performance of their machinery. Predictive maintenance, powered by cutting-edge analytics, allows businesses to foresee potential issues before they escalate, reducing downtime and repair costs significantly.

In a rapidly digitizing environment, integrating smart systems into maintenance protocols becomes essential. For instance, the development of data-driven platforms that monitor equipment health will not only streamline maintenance schedules but also enhance overall operational efficiency. This shift toward intelligent maintenance strategies will likely define the competitive landscape, as organizations that leverage these innovations will find themselves better positioned to respond to market demands and reduce operational disruptions. As 2025 approaches, embracing these advanced service strategies will be paramount for anticipating buyers' needs and ensuring sustained success in the excavator engine parts market.

Future Trends in Excavator Engine Parts: What Global Buyers Should Anticipate in 2025 - Strategies for Optimizing Maintenance and Service in 2025

| Component | Anticipated Advancements | Maintenance Strategies | Expected Impacts |

|---|---|---|---|

| Engine Block | Lightweight materials for improved fuel efficiency | Regular thermal inspections | Reduced fuel costs |

| Fuel Injectors | Enhanced atomization technology | Frequent calibration checks | Improved combustion efficiency |

| Turbochargers | Variable geometry design | Routine performance testing | Higher power output |

| Oil Pumps | Smart oil pressure monitoring systems | Regular oil quality checks | Extended engine life |

| Exhaust Systems | Improved emission control technologies | Periodic emissions testing | Compliance with stricter regulations |